Introduction to the Basis Period Reform The basis period reform for income tax in the UK marks a significant shift in the way self-employed individuals and partnerships calculate their taxable …

Basis Period Reform for the UK 24-25 Tax Year

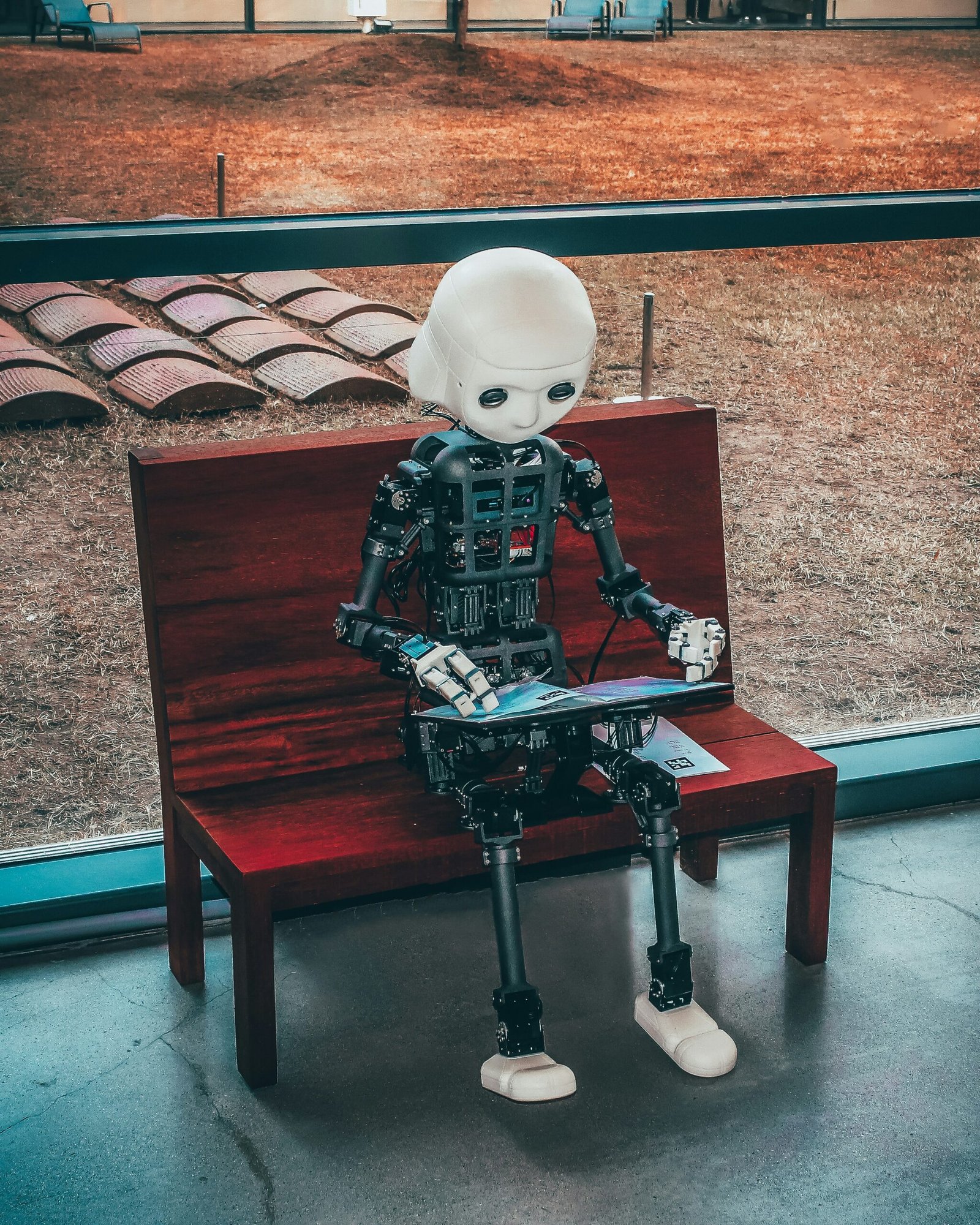

Is AI Taking Over From Your Bookkeeper?

Introduction to AI in Bookkeeping Bookkeeping has undergone a significant transformation over the years. Traditionally, it involved manual data entry, which was time-consuming and prone to human error. With the …

Understanding the Different VAT Schemes Available in the United Kingdom

Introduction to VAT in the UK Value Added Tax (VAT) is a crucial component of the tax system in the United Kingdom, impacting both businesses and consumers. Fundamentally, VAT is …