Introduction to the Basis Period Reform The basis period reform for income tax in the UK marks a significant shift in the way self-employed individuals and partnerships calculate their taxable …

Mon - Thurs: 8.00am - 4pm | Friday 8.00am - 12 Noon

Introduction to the Basis Period Reform The basis period reform for income tax in the UK marks a significant shift in the way self-employed individuals and partnerships calculate their taxable …

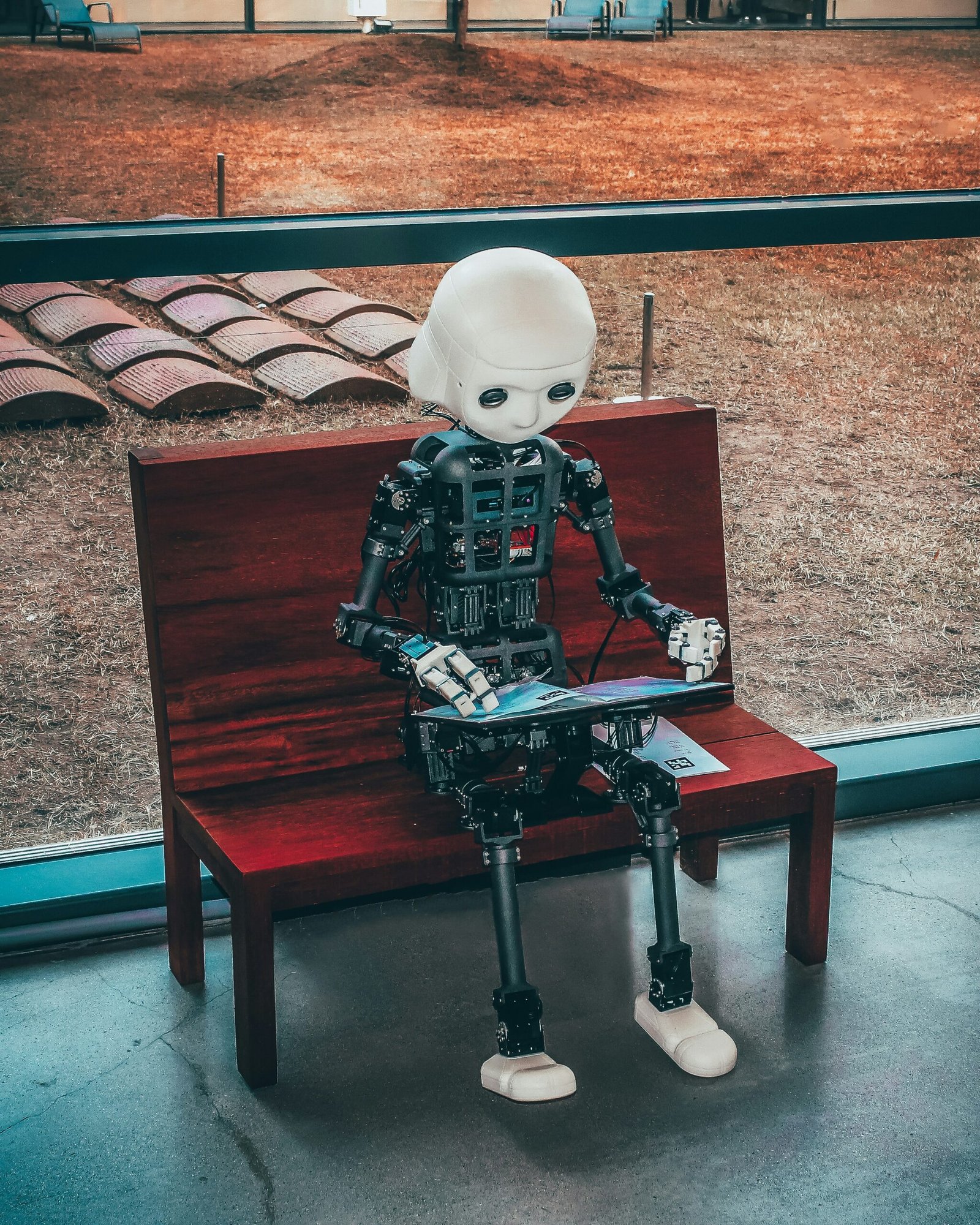

Introduction to AI in Bookkeeping Bookkeeping has undergone a significant transformation over the years. Traditionally, it involved manual data entry, which was time-consuming and prone to human error. With the …

Introduction to VAT in the UK Value Added Tax (VAT) is a crucial component of the tax system in the United Kingdom, impacting both businesses and consumers. Fundamentally, VAT is …

Understanding the New Financial Year End Rules Recent changes to the financial year-end rules for sole traders in the UK have significant implications for how these businesses manage their accounting …

Understanding the Role of a Bookkeeper A bookkeeper plays a pivotal role in the financial health of small businesses. Their primary responsibility revolves around maintaining accurate financial records, which is …

Introduction to Xero Xero is a leading cloud-based accounting software that has revolutionised the way businesses manage their finances. Established in 2006 in New Zealand, Xero quickly expanded its reach …

Self-Employment and Universal Credit in the UK If you’re considering self-employment in the UK and are wondering whether you can claim Universal Credit, then read on. Being self-employed can be …

Understanding Recession: A Period of Economic Downturn A recession is a term used to describe a significant decline in economic activity over a sustained period. It is characterised by a …

Introduction Cash flow management is a critical aspect of running a successful business. It involves monitoring the inflow and outflow of cash to ensure that you have enough funds to …

The Importance of Not Feeling Alone as a Sole Trader It’s crucial to recognise the importance of not feeling alone as a sole trader. Being a sole trader can be …