What is Employment Allowance? Employment Allowance is a significant initiative introduced by the UK government to provide financial relief to eligible employers by reducing their National Insurance contributions (NICs). This …

Employment Allowance in the UK: Eligibility and Application Process

Understanding Pension Re-Enrolment Declarations Every 3 Years in the UK

What is Pension Re-Enrolment? Pension re-enrolment is a crucial aspect of the UK pension system designed to ensure that employees are continuously afforded the opportunity to participate in workplace pension …

Understanding Break-Even in Accounting: A Comprehensive Guide

What is Break-Even Analysis? Lets look at understanding Break-Even in Accounting. Break-even analysis is a fundamental financial assessment tool used in accounting to ascertain the point at which a business’s …

The Benefits of Outsourcing Your Bookkeeping

Introduction to Outsourcing Your Bookkeeping Bookkeeping is a vital component of any business, as it lays the foundation for effective financial management. It involves the systematic recording, reporting, and analysis …

Understanding Employer Pension Obligations in the UK

Introduction to Pension Schemes in the UK Pension schemes in the UK are essential components of the financial framework that provides security for employees in their retirement years. Both employers …

Don’t Forget to Register with HMRC Before October 5th for Self Assessment

Understanding Self Assessment and Its Importance & Deadlines As a first time filer with HMRC you must register by October 5th. Self Assessment is a tax system in the United …

What Employers Hiring Bookkeepers for Small Businesses Need to Consider

Understanding the Role of a Bookkeeper A bookkeeper plays a pivotal role in the financial health of small businesses. Their primary responsibility revolves around maintaining accurate financial records, which is …

Navigating Self-Employment and Universal Credit in the UK

Self-Employment and Universal Credit in the UK If you’re considering self-employment in the UK and are wondering whether you can claim Universal Credit, then read on. Being self-employed can be …

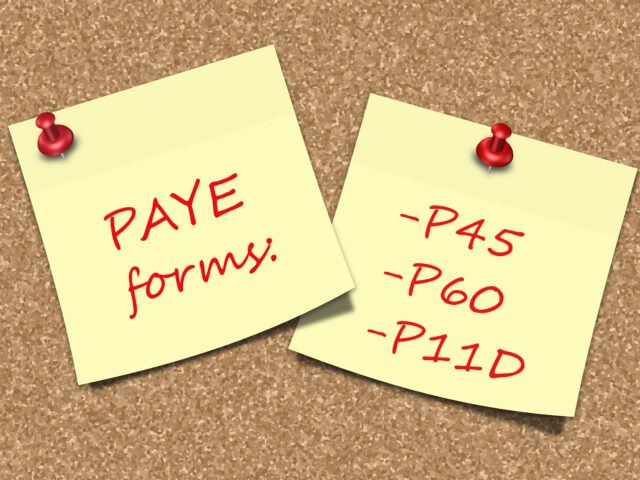

Understanding Your UK Tax Code for PAYE

Understanding Your UK Tax Code for PAYE As an employee in the United Kingdom, understanding your tax code is essential to ensure that you are paying the correct amount of …

The Importance of P60 and P45 Documents in Managing Your Finances and Taxes

Why Do You Need a P60 and P45? The P60 and P45 help when it comes to managing your finances and ensuring that you are paying the correct amount of …